Accounting Systems: From Manual Ledgers to Cloud-Based ERP Powerhouses

Once upon a time, “keeping the books” meant stacks of paper and late nights with a calculator. Today, it means logging in to a secure web portal, seeing every dirham or riyal in real time, and letting automation handle the repetitive work. The modern ERP accounting system has become the nervous system of a business—collecting, processing, and reporting financial data while integrating every department, from sales to supply chain.

His article unpacks:

- What an accounting system is—and why cloud ERP is now the gold standard

- The business value of financial automation, compliance, and real-time insight

- The features that matter most in 2024 (AI, e-invoicing, ESG reporting)

- How Tranquil ERP helps UAE & KSA companies gain full control of their finances

1. Accounting System

An accounting system is a structured environment for collecting, storing, and analyzing financial data. It can be as simple as a spreadsheet or a cloud-based ERP. The latter is rapidly becoming the norm:

“Cloud ERP is no longer just about cost savings. It’s about agility—the ability to access real-time data from anywhere and scale on demand.”

— Evan Goldberg, Founder & EVP, Oracle NetSuite

According to Gartner, by 2026:

- 80% of large enterprises

- and 45% of midsize enterprises

will have deployed a cloud ERP for finance. The reason? It combines the classic accounting pillars—General Ledger, Accounts Payable, Accounts Receivable, and Reporting—with modern capabilities, automated tax filing, and embedded compliance.

2. Why Move to a Cloud-Based ERP Accounting System?

2.1 Automate the Mundane, Reclaim Strategic Time

CFOs say their teams spend 50% of their time on manual transaction processing. Automation can:

- Cut invoice processing costs by up to 80%

- Accelerate processing cycles by 70%

- Shift finance talent toward value-added analysis and forecasting

2.2 Achieve Real-Time Visibility

Waiting until month-end to know your cash position is no longer acceptable. Cloud systems update the General Ledger in real time, enabling:

- Instant P&L, Balance Sheet, and Cash-Flow views

- Interactive dashboards for executives and department heads

- Faster, data-driven decisions

To explore more about how automation and real-time insights drive financial success, read about the key benefits of ERP for accounting and financial management.

2.3 Ensure Built-In Compliance

From IFRS to local VAT rules, regulations are tightening. Integrated systems embed compliance rules directly in workflows, reducing risk and building trust with regulators, investors, and customers.

3. Mandatory E-Invoicing & Digital Tax

Many countries require real-time electronic submission of invoices and tax data. Legacy software struggles; cloud ERP automates compliance and avoids penalties.

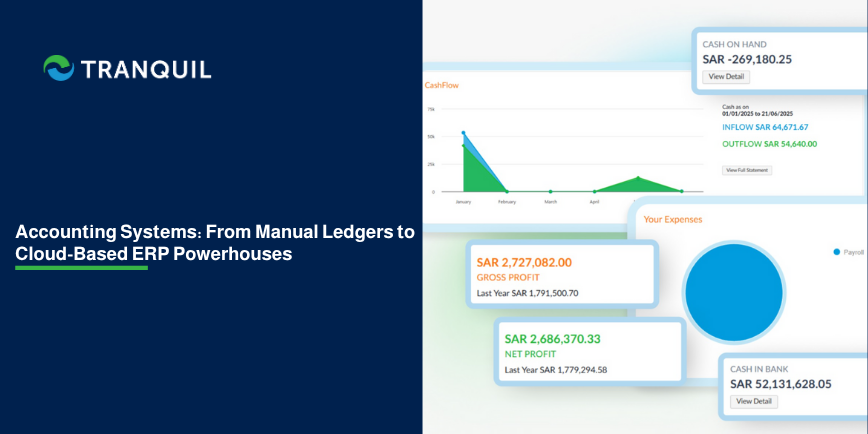

4. Introducing Tranquil: Cloud-Based ERP Accounting Built for KSA & GCC Businesses

Tranquil Business Solutions delivers a fully-featured ERP designed to give small, medium, and large enterprises complete control over their operations. Hosted securely in the cloud, Tranquil Finance module automates transactions, enforces compliance, and produces accurate reports at the click of a button.

| Feature | Description |

|---|---|

| General Ledger | Real-time posting and multi-dimensional analysis for deep insight. |

| Accounts Payable | Automates procure-to-pay, schedules payments, and captures early-payment discounts. |

| Accounts Receivable | Generates invoices, tracks collections, and sends automated reminders to reduce DSO. |

| Financial Reporting & Analytics | Instant P&L, Balance Sheet, and Cash-Flow statements plus customizable dashboards. |

| Asset Management | Tracks acquisition to disposal, automates depreciation, and ensures accurate asset valuation. |

| Cash & Bank Management | Real-time cash visibility and automated bank reconciliation. |

| Tax Management | Automated VAT calculations and filing to stay compliant with KSA & GCC regulations. |

4.1 Key Finance Features at a Glance

- General Ledger – Real-time posting and multi-dimensional analysis for deep insight.

- Accounts Payable – Automates procure-to-pay, schedules payments, and captures early-payment discounts.

- Accounts Receivable – Generates invoices, tracks collections, and sends automated reminders to reduce DSO.

- Financial Reporting & Analytics – Instant P&L, Balance Sheet, and Cash-Flow statements plus customizable dashboards.

- Asset Management – Tracks acquisition to disposal, automates depreciation, and ensures accurate asset valuation.

- Cash & Bank Management – Real-time cash visibility and automated bank reconciliation.

- Tax Management – Automated VAT calculations and filing to stay compliant with UAE & KSA regulations.

4.2 The Tranquil Advantage

| Value Driver | How Tranquil Delivers |

|---|---|

| Automation | Workflow engines eliminate manual invoice entry, approvals, and reconciliations. |

| Compliance | Built-in VAT rules, audit trails, and role-based controls reduce risk. |

| Real-Time Insight | Dashboards refresh instantly, filtered by department, project, or region. |

| Scalability | Multi-entity support handles growth across markets without re-implementation. |

| Local Support | Dedicated teams in the UAE & KSA understand regional requirements and culture. |

5. What Success Looks Like

Companies using cloud ERP are:

- 50% more likely to standardize financial processes

- Closing their books 20% faster

- Enjoying 15% YoY revenue growth among SMBs

6. Ready to Transform Your Finance Function?

If your team is still buried in spreadsheets, wrestling with reconciliations, or losing sleep over VAT filings, it’s time to experience the difference a modern ERP accounting system can make.

Tranquil ERP empowers you to:

- Automate routine tasks and redirect human talent to strategy

- See the full financial picture—anytime, anywhere

- Stay fully compliant with evolving regulations

- Scale effortlessly as your business grows

Gain full control of your finances with Tranquil cloud-based ERP accounting system—because your business deserves more than spreadsheets.